The June market report is out!

With summer in full swing, I hope you're finding time to enjoy the sunshine and spend quality moments with family and friends.

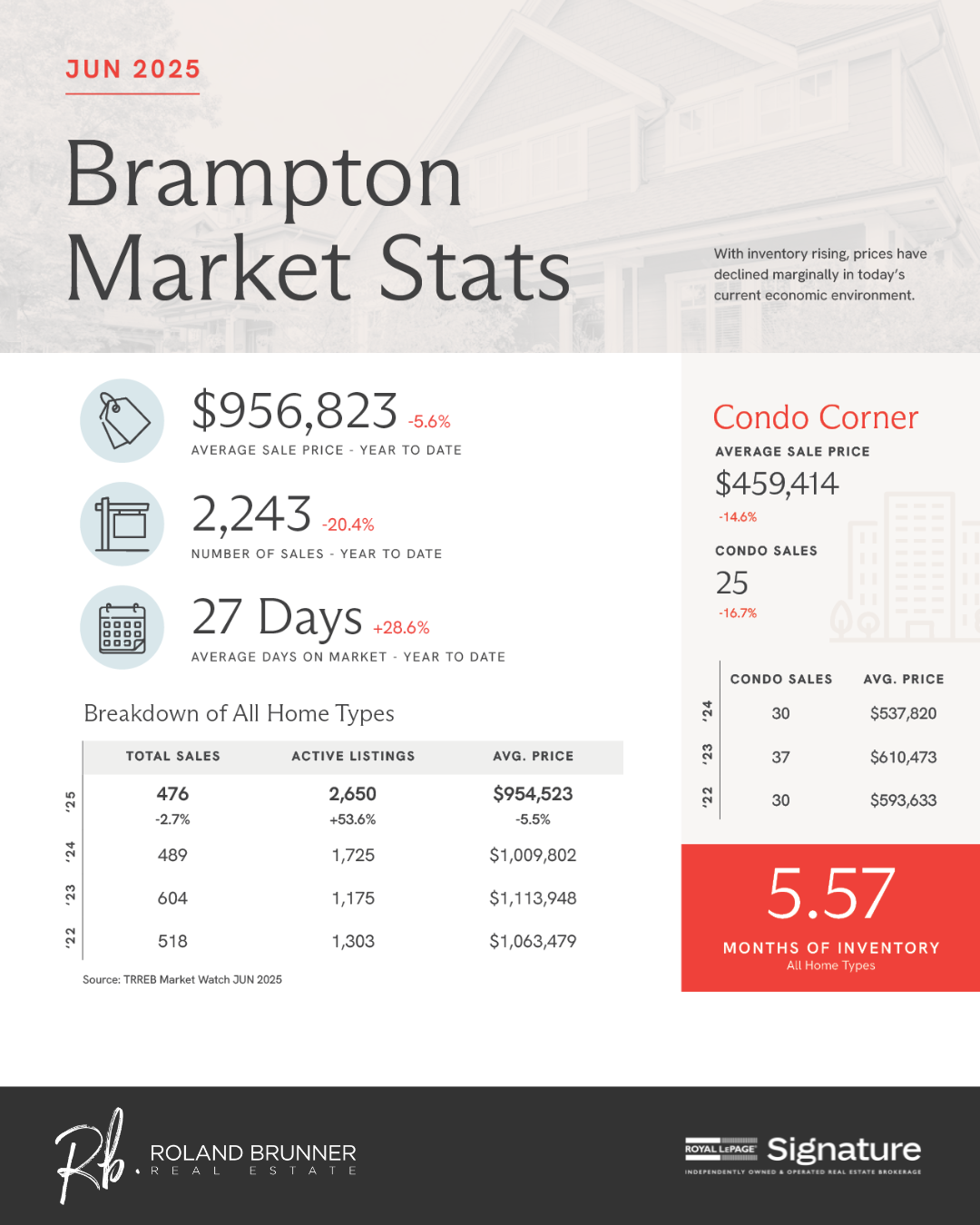

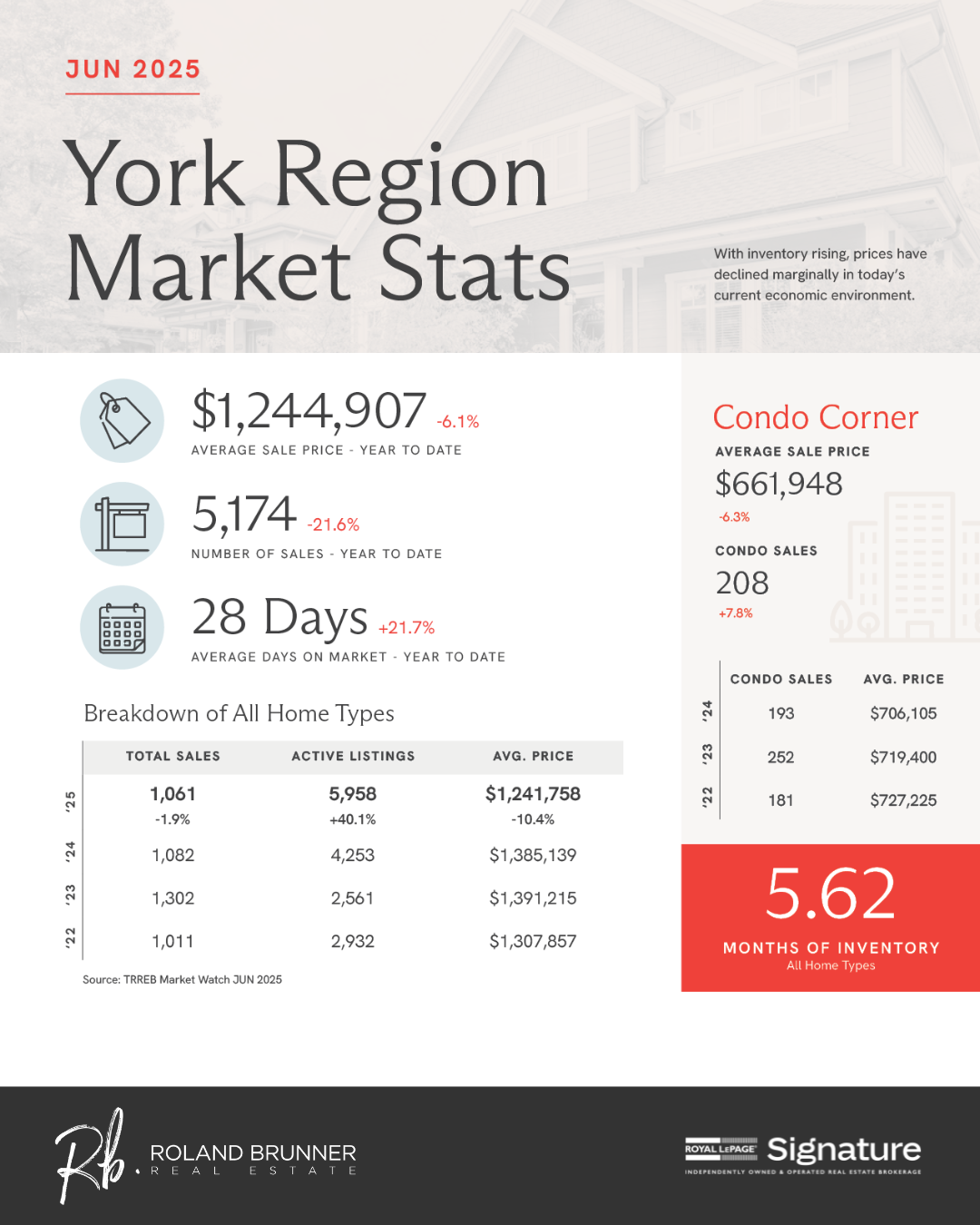

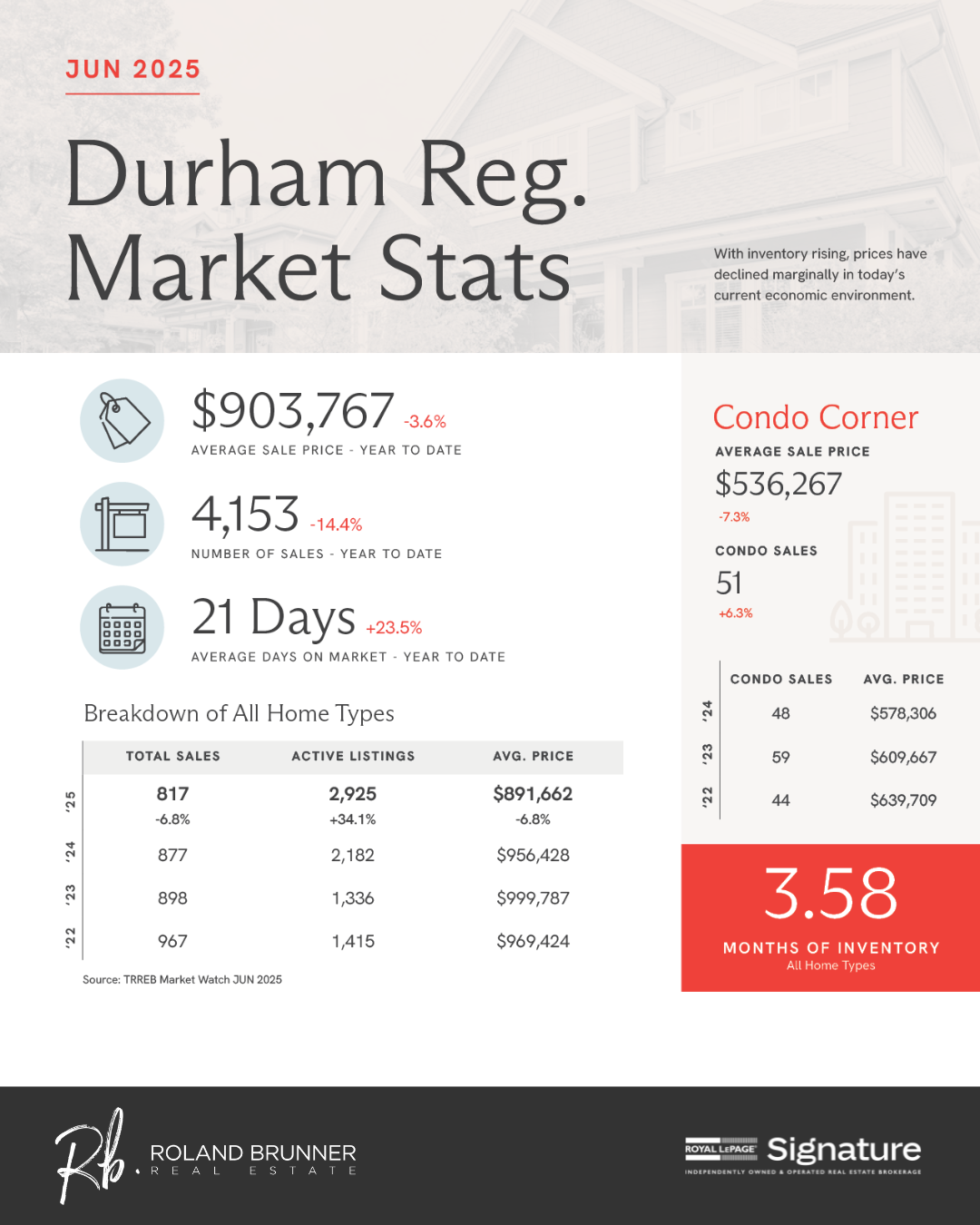

The summer months have brought a welcome shift in the housing market, with increased affordability creating new opportunities for prospective buyers. Both average selling prices and borrowing costs remain below last year’s levels. However, ongoing economic uncertainty continues to keep many would-be buyers on the sidelines, waiting for what they feel is the "right" time to purchase.

That said, June showed encouraging signs of continued market recovery. A growing number of listings gave buyers more choice and room to negotiate on price. When paired with lower borrowing costs compared to a year ago, this environment is helping to make homeownership more accessible for many households in 2025.

In the Greater Toronto Area (GTA), there were 6,243 home sales recorded in June 2025, down 2.4% compared to June 2024, but up month-over-month from May. Interestingly, the number of new listings in June declined from May, indicating a gradual tightening in available inventory.

The average selling price for all home types in June was $1,101,691, a decrease of 5.4% compared to the same time last year.

According to TRREB’s Chief Market Analyst Jason Mercer, resolving cross-border trade tensions could play a key role in strengthening the broader economy and restoring consumer confidence. Additionally, two more interest rate cuts could ease the burden of mortgage payments for average GTA households. These factors would help maintain the positive momentum we've seen in recent months and potentially support selling prices moving forward.

Condo sales in June remained steady year-over-year, though prices declined by 4.3%. Active listings for condos rose by 19% compared to June 2024, with inventory levels holding at approximately seven months. While it's reassuring to see stable sales numbers, the steady influx of new condo units will likely continue to put downward pressure on prices in the near term.