The March market report is out!

Homeownership in the Greater Toronto Area (GTA) became more affordable in March 2025 compared to the same time last year. On average, both borrowing costs and home prices have declined over the past year, making monthly mortgage payments more manageable for buyers. Additional interest rate cuts are anticipated this spring, which may further improve affordability.

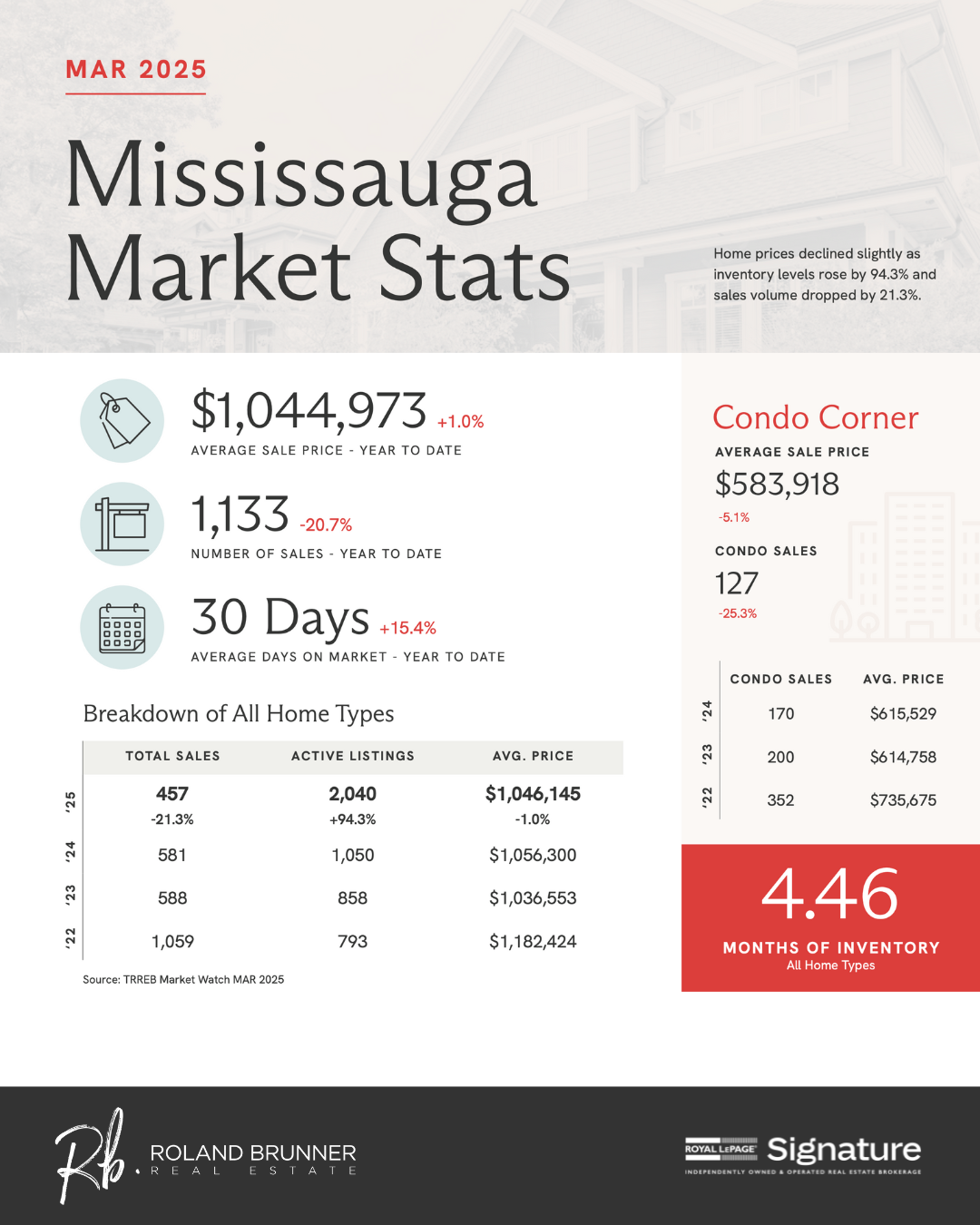

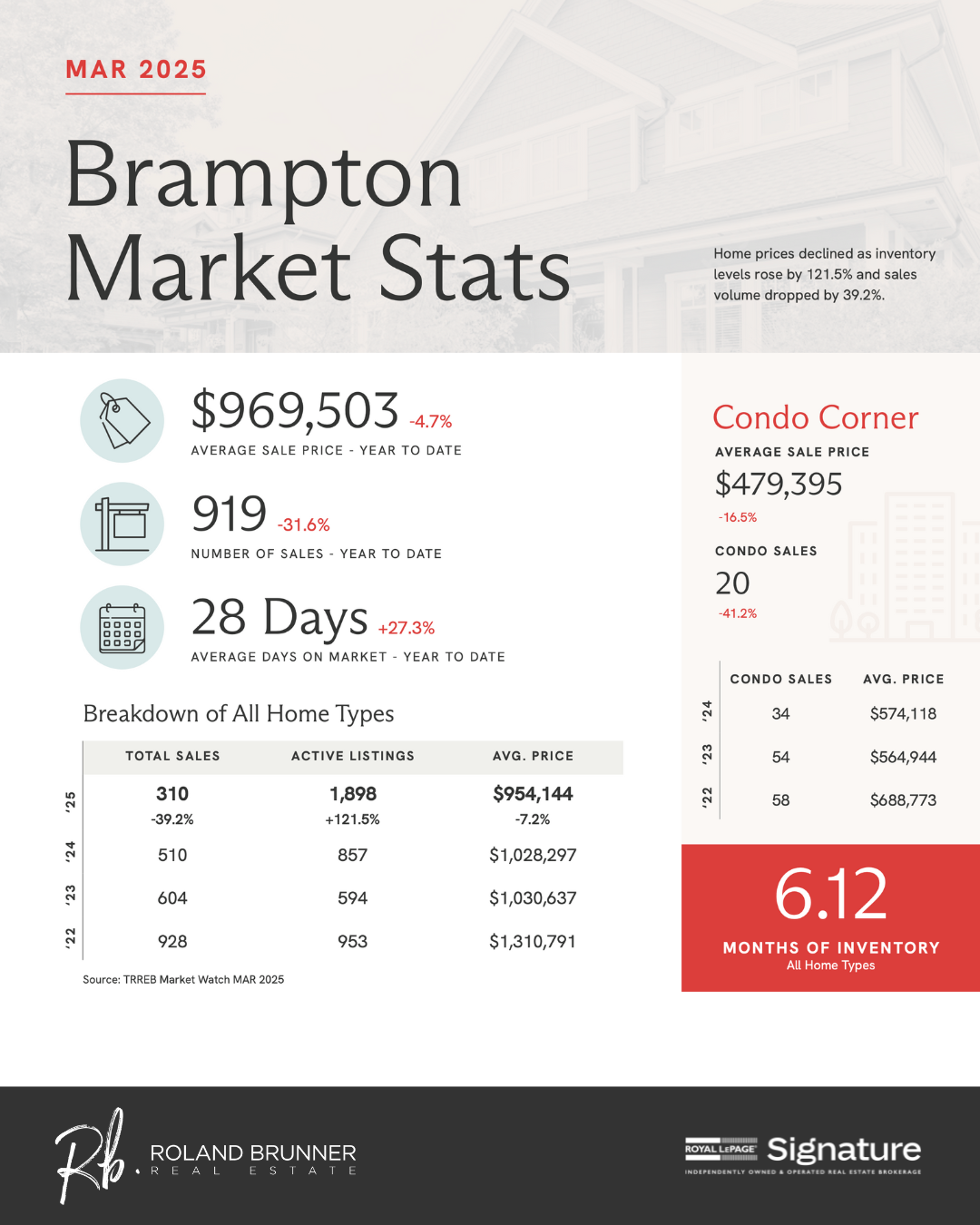

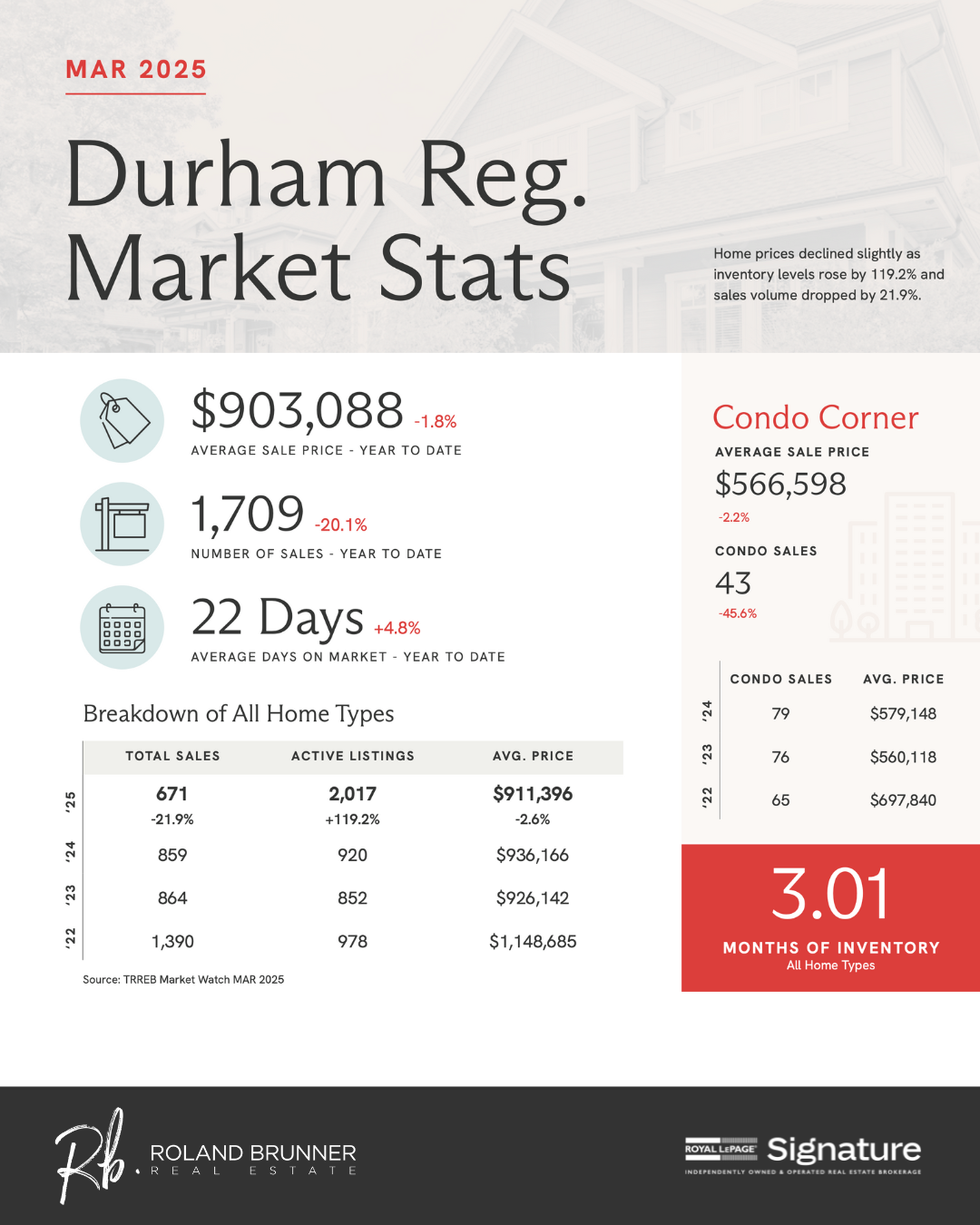

Buyers are also benefiting from increased inventory, giving them more options and greater negotiating power. As consumer confidence in the economy and job security strengthens, we can expect to see a boost in home-buying activity.

According to Jason Mercer, Chief Market Analyst at the Toronto Regional Real Estate Board (TRREB), ongoing trade uncertainty and the approaching federal election may be prompting many households to take a cautious, wait-and-see approach. However, if trade tensions ease or public policy effectively mitigates the impact of tariffs, we could see a rebound in home sales. Ultimately, buyers need to feel confident in their employment stability before committing to long-term mortgage payments.

In March 2025, TRREB reported 5,011 home sales - a 23.1% decrease compared to March 2024. The average selling price fell by 2.5% year-over-year to $1,093,254. At the same time, active listings rose by 9.4% across the GTA, increasing supply and continuing to put downward pressure on prices.

The condominium market has also continued to soften, with a record number of new units being delivered this year. Condo sales volume declined by nearly 25%, while prices dropped a modest 2.6%. This correction is presenting attractive opportunities in the resale condo market.